|

|

True or false? 1Boy, oh boy, what have I got myself into? 3 While doing my previous piece, "Regeneration," I set out to learn from Stephanie Kelton's book about Modern Monetary Theory and try to shorten up the story of how governments affect economies. And that while, as I wrote, "I didn't even know, less understand, the meaning of monetary policy and fiscal policy." Nor, of some other needed terms such as macro- and microeconomics. Fortunately, we have some internet resources to help us out. 4 First those major parts of economics. From Wikipedia: Next come the terms for two government policies. Investopedia tells us that What a hell of a way to begin a story! Sorry about that. If your eyes water over take heart, I will try to make the going easier from here on in. 7 We must clearly keep in mind something that may sound funny at first: it is the distinction between Almost going without saying, also is that users can trust their currencies which is to say that they are well backed by their issuers' assets. For the U.S., Canada, Japan, the U.K., Australia, and quite a few other countries those assets are the sum total of their productive resources which are, quoting Stephanie Kelton, "the state of technology, and the quantity and quality of land, workers, factories, machines, and other materials." These so-called "financially sovereign" countries collect taxes, fines, and duties only in their own currencies. Also, when they issue government bonds those must be denominated in their own currencies only. The Canadian government's Central Bank of Canada, for example, sells Canada Saving Bonds for Canadian dollars and redeems them only in Canadian dollars. The Central Bank's transactions are with the other banks, commercial banks. Those may do conversions to foreign currencies. Similarly in the States; their central bank is the Federal Reserve Bank, lovingly called "the Fed." 9 The euro, which entered the financial world markets in 1999, is now the currency of 19 of the European Union's 27 member states. Those 19 member states let go of their financial sovereignty by fading out their own currencies such as the German mark, the French franc, the Dutch guilder, the Italian lire, and so forth. The euro, I read, ranks second to the U.S. dollar. From the press, I understand that the Chinese yen is vying for the top spot. 10 There are countries that use other people's currencies as their national currency. Ecuador uses the US dollar. Quite a few use the euro. Then there are countries whose currencies are backed by gold or silver. Their financial sovereignty is undermined by the continually changing market value of those commodities as expressed in the world's most trusted currency, said to be the global reserve currency, U.S. dollars. 11 * * *

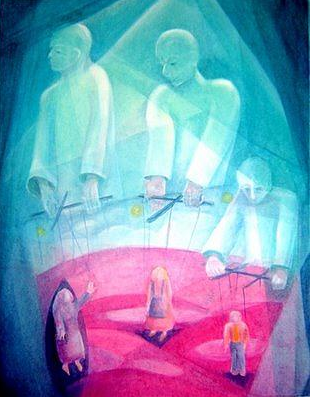

Back to Ms Kelton's book. The full title is "The Deficit Myth: Modern Monetary Theory and the Birth of the People's Economy." That's what caught my eye, "the People's Economy." More than that of a sad-looking picture on the cover that reminds me a bit of Charlie Chaplin, in "Modern Times" (1936): ... Although a tear may be ever so near / That’s the time you must keep on trying / Smile, what’s the use of crying .... 1936? Ah, yes, I am an old fogey. But something is amiss with that picture. 12  What is wrong with this picture? Uncle Sam has no empty pockets. Uncle Sam can print money to his heart's content. That is not to say that he may throw caution to the wind, but printing money can pay off handsomely—until inflation kicks in. 13 The government stamps coins, prints money, and, most if all, creates digital dollars (invisible money in the form of electronic entries on bank balance sheets) for payments via the internet. Users, on their part, pay taxes, duties, fines back to the government. And now the big idea! Putting it very, very, very simply, say the government issues $100 and of this gets back $90 in taxes, and so on, that leaves a shortfall of $10. That deficit goes on the government's books as a number whereas $10 of real value is left in circulation, in goods, in services, in people's pockets. Modern monetary theorists point out that the nation's wealth increased while the score, the "red ink," is simply that, a number. Add up all these numbers over a year and there we have it, an annual deficit. 14 Traditional thinking about "living within our means" boils down to keeping the deficit from going into the red. Households must do that or lose what they have, enterprises must do that or go bust. We all get punished one way or another if we don't. But why should our government? That number on the government's books is not going to hold it to account. And so, why forego that real value left in circulation? That would be a dumb thing to do, would it not? 15 Simple as all that. Needs a little digesting perhaps; it can be hard to change one's mind. There also is a fly in the ointment: an old adage, "If something seems too good to be true, it probably is." The notion that a government should not spend more than it takes in sounds perfectly normal to most people because that is what they themselves have to do. A sad side effect is that it gives politicians a winning line for their campaign rhetoric: "This government is not living within its means! Phooey." Yet, adding up annual deficits gives a number that has been growing year after year without causing us any noticeable harm. Even so, many mainstream economists somehow go along with that imagined hole grail of balancing the books. Well, maybe not much longer. 16 Ms Kelton reminds us of a big problem Barack Obama faced when he became president of the U.S. Four largest financial institutions had lost half their value and the labor market lost hundreds of thousands of jobs a month. Obama was persuaded to get out of this mess by signing a $787 billion economic stimulus package into law. Some of his close advisors had insisted that a minimum of $1.3 trillion would be needed to avoid a long-lasting recession. Apparently that word "trillion" got on his nerve because he was a conservative at heart when it comes to fiscal policy. Eventually, things had picked up nicely when eight years later Donald Trump took over the presidency. Remember? Ouch, another fly in the ointment—the voting public, taken as a whole, has a lousy memory. 17 Leafing through the news, it seems that Modern Monetary Theorists are getting help from something even more dismal than economists, Covid-19. Found a line in the press a few days ago (on June 14): "Given the huge financial costs of the COVID-19 pandemic, MMT is something we're hearing about more and more. Is it a whacky, flavour of the month theory, or is it the path forward?" Maybe I got it wrong, but right now I tend to perceive economics as a big bundle of notions that need to continually adapt to the times. Modern times in 1936 aren't modern today. How long will a modern theory today stand the test of time? 18 The explanation of MMT given a couple of paragraphs ago— the creation of $10 of wealth out of thin air—is clearly overly simplistic. For one, it ignores why those other 90 bucks should be returned to the government. Why does the government bother taxing and borrowing at all if it can simply print it? Ms Kelton gives us four reasons why. Let's go back to that second reason, avoiding inflation. The trick is to foresee inflation coming, but a problem is that while government officials are trying to sort out how to advise their political masters about what to do, the economic sands are shifting under their feet. While government officials are trying to sort out how to advise their political masters, the economic sands are shifting under their feet. Wrote Ms Kelton that it is impossible to disentangle what is going on in the economy at any one point in time. On any given day, there are millions of moving parts. Throughout the year, in the U.S., the Federal Reserve handles trillions of dollars of Treasury payments. Each month, millions of households and businesses write checks to Uncle Sam, and those payments clear between commercial banks and the Federal Reserve. On top of which I am thinking of the nooks and crannies in the dark alleyways of microeconomics, the schlimazelling, the hiding of fortunes in secret bank accounts (notably in Switserland, the Bahamas), the infestation of black money into the legitimate economy (paving, funeral homes, old-age residences, real estate come to mind). Heaven knows what else. 20 I am looking here at a bookseller's description of a first-year economics textbook ("Macroeconomics," by Mitchell, Wray and Watts) that compares orthodox and heterodox views of the subject and discusses, a reviewer tells us, "topics at an introductory level such as measurement of inequality, endogenous money" [whatever that is] "and Modern Money Theory (MMT), quantitative easing, negative interest rate policies, theory of effective demand, full employment policy, economic instability, and environmetal sustainability.... not only for beginning students, but also even for professional economists." That is a text for students' first year, a long way of study still ahead of them. And we, the voters in our democratic society, have to make up our minds which riding representative or which party to support in the next election! Go figure. 20a Forestalling inflation takes a lot of guesswork. Elected politicians in charge face another problem as well: convincing an ignorant electorate that they doing the right thing, which to my mind is the Achilles heel of democracy. Without the pandemic, would it have been considered worthwhile, politically sane that is, to go this route? 21 What we say and what we do are different things. "Socialism," in America, is a dirty word, but its citizens love handouts. Tax breaks for the rich; entitlement programs for those whose livelihood is not as secure. Republicans in the U.S., Conservatives in Canada like to promote the notion that entitlement programs like social seurity and medicare are financially unsustainable. "We can't afford them anymore." Modern monetary theorists hold that this is a myth. As long as the federal government commits to making those payments, it can always afford to support these programs. What matters is our economy's long-run capacity to produce the real goods and services people will need. 22 After dispelling the deficit myth, Stephanie Kelton devotes a chapter to another kind of deficits: stable jobs, proper health care, proper education, well-maintained infrastructure (roads, bridges, water and electricity supply, and so on), alleviating climate change, fixing democracy. She hadn't run into Covid-19 yet. She then went on to "The Peoples' Economy." 23 Going back to President Obama's $787 billion stimulas package in 2009, the man who came up with the MMT, Warren Mosler (who was not an economist by profession), thought that it was not nearly good enough. Mosler believed that Congress culd essentially fix things in three easy steps. First, a federally funded job guarantee to put every unemployed worker immediately back into paid employment. Secondly—I am pretty well quoting the book—he called for a payroll tax holiday that would have temporarily cut out the withholding of Social Security payroll tax of 6.2 percent. That amounts to (a) a 6.2 percent pay raise for about 150 million Americans and (b) leaves twice that percentage with those self-employed workers who pay both the employer and employee side of the withholding tax. And as these people's spending picks up, the bottom line of millions of companies would begin to rebound as well. Thirdly, Mosler recognized the enormous impact of the previous century's Great Recession on the budgets of state and local governments. To help out those currency-using governments, he proposed a distribution of $500 billion to help them out. That would have protected tens of thousands of teachers, firefighters, police, and other public sector workers. 24 Whew, that was a bit of a tough paragraph. Maybe look at it again and thereby sense what has been happening here in Canada in recent months: our own federal government providing aid packages for the unemployed and for middle-class enterprises, and provincial governments holding out their hands for more financial aid to do their thing. While governments must be held to account for what they are doing, our Prime Minister is loath to state how it will move ahead Uncertainty still rules Big Time. 25 * * *

I should leave it here, I guess. I am not an economist. All I hope for is that we get the picture, sort of. For greater enlightenment, read Stephanie Kelton's book. And for eager beavers willing to spend a hundred bucks there is that first-year economics textbook, "Macroeconomics." 26 And don't forget to vote next time around. 28

|

--

| top of page |

|